MENDIOLA LAW OFFICE

Mendiola Avocats advises, assists, and represent its clients, residents, and non-residents, in all of their legal, tax, and heritage issues, in a Franco-French as well as international context.

Mendiola Avocats is built and shaped around the needs of our clients who we form long-lasting relationships with. They entrust us with their most challenging and complex problems in the areas in which we practice, such as private client services, domestic and international tax law, family, and immigration law.

We provide our clients with clear and comprehensive advice not merely to explain legal framework but to give solutions on how to achieve their objectives and implement solutions.

We offer tailored-made and boutique services in various fields and we have a strong international network who share our values and standards, to provide our clients with the highest possible level of service.

Our team is fluent in French, English and Spanish. Being multicultural, we are ideally placed to advise and represent worldwide clients.

Mendiola Avocats is ideally located in 8 th district of Paris, just a step from the iconic Arc de Triomphe.

EXPERTISE

Mendiola Avocats advises not only families and entrepreneurs, but also employees, artists, students and international business men and women.

Our firm offers unique, pragmatic, and global advice in a legal, tax and multi-jurisdictional environment which is becoming ever more complex.

TAX PLANNING

Mendiola Lawyers is studying the terms and tax consequences of transferring the domicile of its clients who leave France or settle there. The Firm assists them in the determination and execution of their tax obligation

Mendiola Lawyers assists its clients who wish to acquire or transfer property, by determining the most advantageous schemes. These may be donations, anticipation of their succession, transfers for consideration or acquisitions of assets, taking into account their current and future interests.

Mendiola Lawyers advises its clients who wish to acquire a property or reorganize their assets, on all the tax aspects of the operation, so as to enable them to structure their investment in the best of their interests.

WEALTH AND FAMILIY

We assist our clients to organize their wealth, to sustain it and plan its succession from generation to generation in an efficient and flexible manner. We strive to protect our clients’ personal interests and wealth, to anticipate and avoid future family conflicts and to help them be tax efficient and compliant.

International couples are often confronted to the difficulty of finding clear and reliable advice when it comes to divorce in France.

Mendiola Avocats advises international clients living in France but also French clients married to French or non-French individuals, when they wish to divorce by mutual consent (divorce without judge). This implies that both spouses agree on the very principle of divorce, but also on its consequences between them and with regards to children. We prioritize this procedure as we are convinced it is the fastest, least expensive, and least stressful way for the spouses to end their marriage.

Mendiola Lawyers assists its clients in issuing and renewing their residence permit and in compiling their naturalization file. The Firm also intervenes when they are forced by the Obligation to leave French territory (OQTF) or the Ban on returning to French territory (IRTF), or when they obtain a refusal decision.

OUR TEAM

KAREN MENDIOLA

Karen Mendiola is the founder of Mendiola Avocats, a practice dedicated to local and international private client services, domestic and international tax law, family and immigration law.

Karen works on all issues concerning wealth engineering, estate planning, cross-border tax relations and tax regularizations, as well as divorce matters.

Education

Certificate of Aptitude for the Legal Profession (Certificat d’aptitude à la profession d’avocats)

Specialized Master in International Wealth Management, ESCP EUROPE

Law degree, Instituto Tecnológico y de Estudios Superiores de Monterrey (ITESM) Preparatory school, ITESM

Bars

Member of the Bar in Paris and Mexico

Languages

French, Spanish, English

MARITZA MENDIOLA

Maritza provides advise and support to international individuals for all immigration related procedures required to legally enter France, on a permanent or temporary basis.

She guides our clients on all administrative procedures for obtaining visas, work authorization, and residency permits for their international transfer and that of their family members to France.

Education

CIFFOP, DU Compensations & Benefits

Erasmus University Rotterdam and Paris-Panthéon-Assas University – Double Master in public international law.

Autonomous University of Mexico State – Law degree

Bars

Member of the Bar in Mexico

Language

Spanish, French, English

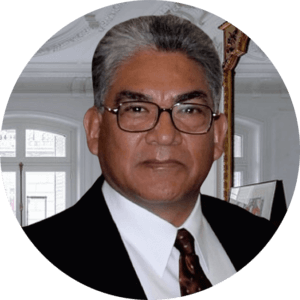

ANDRÉS MENDIOLA

Andrés is a Mexican-based honorary lawyer with over 35 years of experience in Mexican civil and criminal law and proceedings.

Mendiola Avocats reaches out to Andrés for advise in Mexican law and also procedures and formalities with public and private entities.

FEES

Clients are informed of how fees are calculated. These can be considered in three ways, depending on the situation and in agreement with the client.

— Fees based on time spent

The fees for time spent are calculated on the basis of an hourly rate determined in agreement with the client and according to the issues and the complexity of the file.

— Flat-rate fees

Fixed fees are preferred when the time to be devoted to the mission is determinable. This is the case, for example, for the preparation of income tax (IR) and real estate wealth tax (ISF) declarations, non-complex divorce, etc.

— Fees based on results

Depending on the situation, it is possible to add to the fixed fee, a performance fee, the amount of which is calculated according to a percentage of the result obtained. This formula can be considered in particular in the context of tax adjustments, regularization of assets held abroad, or obtaining compensation.

– Expenses

The costs and disbursements within the meaning of article 267 of the CGI (couriers, translations, registration of documents, procedural fees, costs of service, bailiff, etc.), advanced by the firm in the name and on behalf of the client, will be the subject of a separate section during invoicing, and will be re-invoiced to him to the nearest euro, with the relevant supporting documents. No significant expenditure will be made without the prior agreement of the client.